- Home

- Assessments

- Bioregional Assessment Program

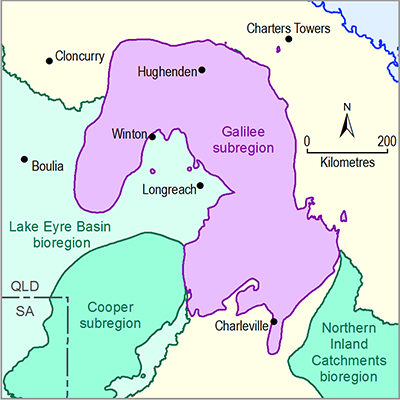

- Galilee subregion

- 1.2 Resource assessment for the Galilee subregion

- 1.2.3 Proposals and exploration

Development proposals are well-advanced for six large scale thermal coal mining operations, spread-out across a 200 km long north-trending corridor close to the eastern margin of the geological Galilee Basin. Most of these will involve a staged combination of multiple open-cut pits and underground longwall mines and, at full production, each project expects to extract between 15 and 60 Mt of raw coal per year. Four proposals have recently received conditional approval to proceed to the construction phase following Queensland and Australian Government assessment of the environmental impact statement (EIS) documentation. These are the GVK Hancock Coal operations at the Alpha and Kevin’s Corner deposits, Waratah Coal Pty Ltd’s (Waratah Coal’s) China First project near Alpha township, and Adani Mining Pty Ltd’s (Adani Mining’s) Carmichael development in the north-east of the basin, which has the potential to become Australia’s largest coal mine when fully operational. Additionally, the proposed open-cut and underground developments at South Galilee and China Stone are currently within the EIS approvals system.

A further eight proposed large coal mining developments, most with current mining lease applications or mineral development licences, occur in the eastern and northern Galilee subregion. These are the Alpha North, Clyde Park, Alpha West, Carmichael East, West Pentland, Pentland, Degulla and Hyde Park coal projects. In addition, East Energy Resources Limited’s (EER’s) Blackall deposit in the southern part of the Galilee subregion is the most advanced proposal for mining of lower rank coals hosted in the Cretaceous Winton Formation (Eromanga Basin). All of these proposals are at various stages of planning, such as initial concept design and pre-feasibility studies. The companies seeking to develop these sites are yet to submit an EIS, although information available for several projects suggests that at least some may seek statutory approval in the future.

Future coal exploration activity is expected to continue in the most prospective regions of the Galilee Basin, although at reduced levels from those experienced between 2008 and 2013. However, several companies have recently identified upside exploration potential in the basin with new resource announcements. These include an approximate 1100 Mt thermal coal resource at Hughenden (Guildford Coal Limited (Guildford Coal)), a 364 Mt inferred resource at Yellow Jacket (Cuesta Coal Limited (Cuesta)), and a 322 Mt maiden inferred resource at South Pentland (Cockatoo Coal Limited (Cockatoo Coal)). Significant coal discoveries have also been made in the Eromanga Basin within the Galilee subregion, including the 1300 Mt inferred resource at Coalbank Limited’s (Coalbank’s) Inverness deposit.

The development of a coal seam gas (CSG) production industry in the Galilee Basin is significantly less-advanced than for coal. Evaluation and testing of initial exploration wells has thus far led to three separate contingent (2C and 3C) CSG resource announcements. However, CSG reserves have yet to be defined. The most advanced project is operated by an AGL Energy Ltd (AGL) – Galilee Energy Ltd (Galilee Energy) joint venture, and is known as the Galilee Gas Project. Focused on the Glenaras site, a 259 petajoule (PJ) 2C gas resource has been defined. At Glenaras, a five-well pilot has been operating since 2009, and successful gas flows have proven that CSG production is technically feasible in the basin. Other CSG production testing has been undertaken at the Gunn Project site to the east of Glenaras. The petroleum exploration tenements that include the Gunn site are operated by Comet Ridge Limited (Comet Ridge), which has identified a 2C gas resource of 67 PJ and 3C resource of 1870 PJ. Both the Glenaras and Gunn CSG operations require a significant amount of further testing and appraisal before investment decisions on the economic viability of establishing full-scale production can be confidently made. Current indications from industry representatives suggest that any future commercial CSG operations in the Galilee Basin are likely to be at least a decade (or more) away.

Product Finalisation date

- 1.2.1 Available coal and coal seam gas resources

- 1.2.2 Current activity and tenements

- 1.2.3 Proposals and exploration

- 1.2.3.1 Coal

- 1.2.3.1.1 Alpha Coal Project

- 1.2.3.1.2 Kevin's Corner Coal Project

- 1.2.3.1.3 China First Coal Project

- 1.2.3.1.4 Carmichael Coal Mine and Rail Project

- 1.2.3.1.5 South Galilee Coal Project

- 1.2.3.1.6 China Stone Coal Project

- 1.2.3.1.7 Alpha North Coal Project

- 1.2.3.1.8 Clyde Park Coal Project

- 1.2.3.1.9 Alpha West Coal Project

- 1.2.3.1.10 Carmichael East Coal Project

- 1.2.3.1.11 West Pentland Coal Project

- 1.2.3.1.12 Pentland Coal Project

- 1.2.3.1.13 Degulla Coal Project

- 1.2.3.1.14 Hyde Park Coal Project

- 1.2.3.1.15 Blackall Coal Project

- 1.2.3.1.16 Regional coal exploration in Galilee Basin

- 1.2.3.1.17 Galilee Basin State Development Area

- 1.2.3.2 Coal seam gas

- References

- 1.2.3.1 Coal

- 1.2.4 Catalogue of potential resource developments

- Appendix A

- Citation

- Acknowledgements

- Contributors to the Technical Programme

- About this technical product